Share this:

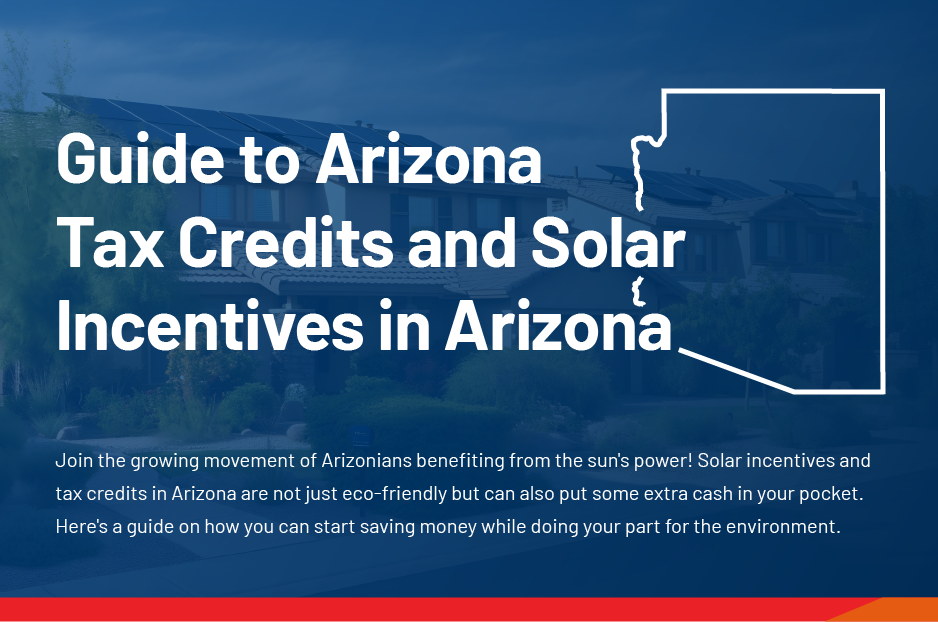

A Homeowners guide to going solar.

A Homeowners guide to going solar.

What Are Arizona Tax Incentives?

- Arizona offers various tax incentives and credits to make solar power installations more affordable for both residential and non-residential setups

- Financial incentives provided are divided between residential and non-residential installations

- Incentives include personal tax credits, corporate tax credits, sales tax exemptions, and property tax exemptions

- It is worth noting that these programs’ specifics might change over time and vary depending on the scale and type of installations.

Residential Solar Incentives in Arizona

Homeowners in Arizona can access several financial incentives to install solar power systems.

- Residential Solar and Wind Energy Systems Tax Credit: This personal tax credit offers 25% of the cost of solar and wind energy systems, up to a $1,000 maximum

- Solar Hot Water Heater Plumbing Stub Out and Electric Vehicle Charging Station Outlet Credit: Arizona offers a $75 nonrefundable individual and corporate income tax credits for installing these energy-efficient systems

- Solar and Wind Equipment Sales Tax Exemption: 100% of the sales tax on eligible equipment is exempted, and the equipment includes photovoltaics, solar water heat, solar space heat, and more

- Energy Equipment Property Tax Exemption: This exemption applies to the increased value of the property from installing renewable energy systems

Non-Residential Solar Incentives in Arizona

For non-residential installations, Arizona provides several tax incentives and

credits to promote the adoption of renewable energy.

- Non-Residential Solar & Wind Tax Credit: Businesses can get up to

$25,000 credit for any one building in the same year and a total credit of $50,000 per business in any year - Renewable Energy Production Tax Credit: This incentive offers a Corporate Tax Credit for electricity produced by certain eligible renewable systems over a ten-year period

- Renewable Energy Business Tax Incentives: Aimed at drawing renewable energy product manufacturers to Arizona, this tax credit is up to 10% of the investment amount

Federal Solar Investment Tax Credit (ITC)

- Residential solar panels installed by December 31, 2032, are eligible for a 30% tax credit

- The ITC rolls over up to five years if the credit is greater than your owed taxes

- The average 11.5 kW system could yield around $9,000 in tax credits In 2022, thanks to the Inflation Reduction Act, the tax credit was increased from 26% to 30% of the system value

- The ITC schedule is: 30% of your total system value for installations between 2022 and 2031, 26% for installations in 2032, and 22% for installations in 2033

Local Solar Incentives in Arizona

- Several local incentives and rebate programs are available depending on your utility and the type of solar system installed

- Examples include the APS Residential Battery Pilot program, MEC SunWatts Renewable Energy Incentive Program, and the Salt River Project Demand Management System Rebate

Net Billing in Arizona

- Arizona has replaced net metering with net billing, where excess energy produced by your solar panels is credited at less than the retail rate

- The rate varies by your utility and its electricity rates

- Despite being less beneficial than net metering, net billing still offers substantial savings on energy bills

Eligible Technologies for Solar Incentives

- Photovoltaics

- Solar water heat

- Passive solar space heat

- Solar space heat

- Wind

- Solar ovens

- Solar cooling

- Solar pool heating

- Daylighting

Cost and Savings

- The average cost of solar panels in Arizona, before tax credits or rebates, is around $18,000 to $22,000 for a standard 6kW system

- You can typically expect to pay around $2.81 per watt as of 2021

- The cost of solar panels has been decreasing, making solar power more accessible to Arizona homeowners

- Going solar can significantly reduce or even eliminate your monthly electricity bills

- On average, Arizona homeowners with solar power systems save around $100 to $150 on their monthly electricity bills

- With tax credits, incentives, and energy savings, most homeowners recoup their investment in 7 to 8 years

- Over the lifetime of a solar panel system (25+ years), homeowners can save tens of thousands of dollars

- Exact savings amounts will depend on the size and efficiency of your system and your household’s energy usage

Advantages of Going Solar in Arizona

Expanding solar power usage in Arizona holds numerous potential benefits.

- Encourages the use of renewable energy

- Lower carbon footprint

- Reduces reliance on non-renewable resources

- Lowers average monthly electricity bills

- Enables storage of excess energy for future use

- Stabilizes energy prices

- Can increase property value

- New jobs and industries created

- Decreases dependence on foreign energy sources

Potential Increase in Property Value and Tax Exemptions

- Homes equipped with solar power systems have been shown to increase in value

- Studies suggest that homeowners can expect an increase in property value by approximately $20,000 for every 5 kilowatts (kW) of solar installed

- Solar installations can enhance the marketability of a home, making it a worthwhile long-term investment

- In Arizona, solar panels are eligible for a property tax exemption, so if your solar panel system increases the value of your

Understanding Tax Credit Forms

- Use Arizona Form 310 to enter the value of solar energy devices

- Calculate 25% of the entered value and limit to $1,000

- Consolidate tax credits using Form 301

- Final credit value is entered on forms 140, 140PY, 140NR, or 140X, depending on individual situations

Understanding Corporate Tax Credit Applications

- To qualify for tax credits, businesses must submit an application to the Arizona Commerce Authority (ACA)

- The application process may vary based on the type of business and energy technology used

- Familiarize with the application process for an efficient tax credit application

Arizona Solar Power vs. Traditional Electricity Sources

- The use of solar power helps reduce greenhouse gas emissions and our reliance on non-renewable energy sources

- Solar power is a clean source of energy unlike other electricity sources like fossil fuels

- Moving to solar energy saves money and contributes to the fight against climate change